How BC Homeowners Get Paid to Charge EVs with Solar: The Real Math

December 2, 2025

Western Super-Grid: Will Your Alberta Solar Finally Get a Better Deal from BC Hydro?

December 4, 2025Solar battery prices are stubborn. If you have noticed the price of new solar batteries refusing to drop, you are not alone. Canadian Solar is now moving some of its battery and solar panel manufacturing to the United States. They want to cut supply chain risks and qualify for subsidies by making products closer to home.

You might be asking yourself: does a factory in Kentucky or Indiana actually help me here in Canada?

I have walked hundreds of Canadian homeowners through their installs over the last 12 years. I can tell you this shift is about more than just where the factory sits. It is about supply chain security, faster delivery to our provinces, and avoiding the unpredictable tariffs that often spike prices overnight.

This breakdown shows how this shift affects what you pay for new clean energy systems in Canada. Grab a coffee. Let’s look at the numbers and see if cheaper batteries are actually within reach.

Key Takeaways

- Massive Investment: Canadian Solar is investing heavily in U.S. manufacturing. This includes an $800 million solar cell plant in Jeffersonville, Indiana, and a $712 million battery facility in Shelbyville, Kentucky. Both aim to ramp up production between late 2025 and 2026.

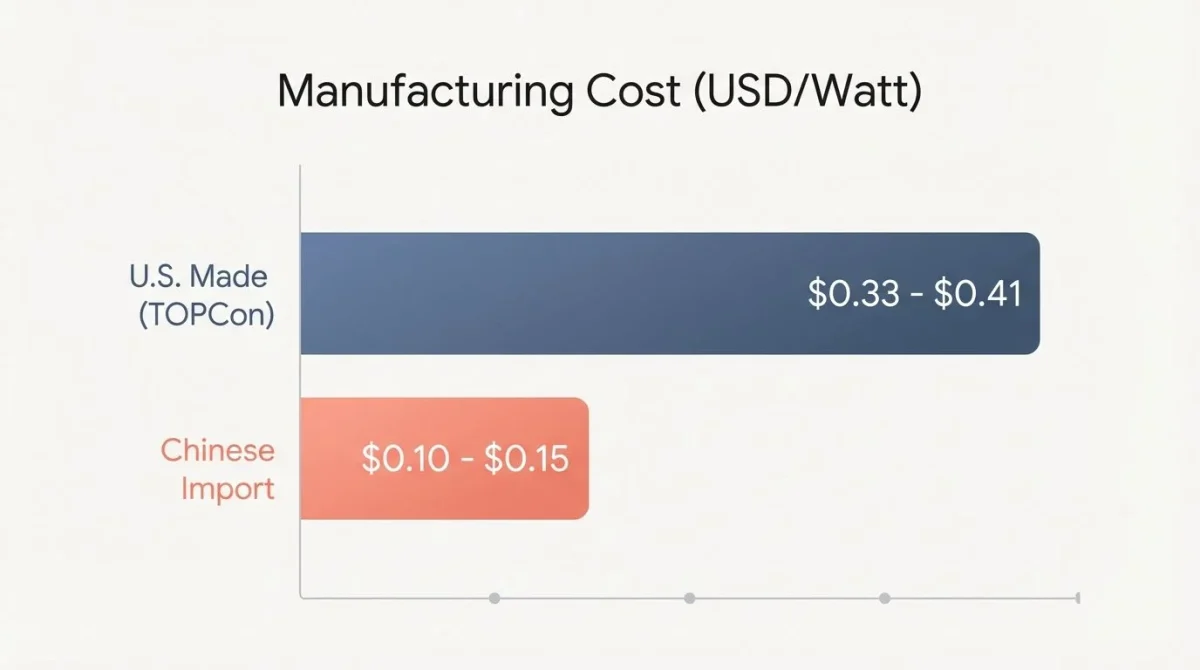

- The Price Gap: Manufacturing costs differ significantly. Chinese modules often sell around US$0.09–$0.11 per watt FOB. U.S.-made TOPCon modules have a modelled cost of US$0.33–$0.41 per watt before subsidies.

- Faster Shipping: Local manufacturing in Mesquite, Texas, and the upcoming Midwest plants will reduce shipping times to Canada from weeks on the ocean to just days by rail or truck.

- Subsidies at Work: Federal incentives like the Inflation Reduction Act (IRA) help bridge the cost gap. They provide credits up to US$45 per kWh combined for US-made battery cells and modules.

- What to Buy: When comparing options, look beyond the sticker price. Seek warranties of 10 years or longer and performance specs like cycle life above 6,000 cycles—standard for LFP batteries like the residential EP Cube.

The Shift to U.S. Manufacturing

Canadian Solar is shifting significant operations to North American ownership. They are establishing a clear division of labour across their new sites: a module assembly facility in Mesquite, Texas; a solar cell plant in Jeffersonville, Indiana; and a lithium battery factory in Shelbyville, Kentucky.

To make this work, they formed a new U.S. entity called CS PowerTech. Canadian Solar holds a 75.1% stake in this venture after acquiring the majority share for about US$50 million. Note that the $50 million was just for the share acquisition—the actual factories cost hundreds of millions more to build.

This move reduces reliance on Chinese manufacturing. It directly addresses rising U.S. trade protections and tariffs on imported photovoltaic modules and batteries. The goal is to boost local production capacity and supply chain security for North American customers.

We need to look at the specific facilities to understand what is actually being built.

What Are They Building?

It is important to get the details right because different factories make different components. The setup is specific.

Facility Breakdown

| Location | Product Focus | Capacity / Investment | Target Timeline |

|---|---|---|---|

| Mesquite, Texas | Solar PV Modules | 5 GW (approx. 20,000 modules/day) | Operational |

| Jeffersonville, Indiana | Solar PV Cells | 5 GW / US$800 Million | Production by end of 2025 |

| Shelbyville, Kentucky | Utility-Scale Batteries | 3 GWh – 6 GWh / US$712 Million | Start late 2025, ramp in 2026 |

The Jeffersonville plant will produce the solar cells. These cells are then shipped to Mesquite to be assembled into the final panels.

Meanwhile, the Shelbyville facility is dedicated to utility-scale battery storage (like the SolBank), not necessarily the small battery hanging in your garage yet.

Dr. Shawn Qu, Chairman and CEO of Canadian Solar, noted that localizing production builds a shield against global logistics disruptions. This is about creating a reliable supply network that complies with U.S. government regulations such as Foreign Entity of Concern (FEOC) rules.

How This Complies with the Inflation Reduction Act (IRA)

The new U.S. facilities allow Canadian Solar to qualify for subsidies under the Inflation Reduction Act (IRA). This legislation offers a ten-year Investment Tax Credit (ITC) and Production Tax Credit (PTC).

The Section 45X credit is the big driver here. It provides specific dollar amounts for every component produced domestically.

- Solar Modules: Approximately US$0.07 per watt.

- Solar Cells: Approximately US$0.04 per watt.

- Battery Cells: US$35 per kWh of capacity.

- Battery Modules: US$10 per kWh of capacity.

If a battery manufacturer makes both the cells and the modules in the U.S., they can claim a combined credit of US$45 per kWh. This allows Canadian Solar to avoid restrictions that block projects using Chinese-linked components from accessing these credits.

Learn more about Section 45X credits here.

Faster Delivery for Canadian Projects

Local production changes the logistics game. Establishing a solar cell facility in Indiana and a battery factory in Kentucky replaces the 4-6 week ocean freight journey from Asia with a few days of rail or truck transport.

Vitaliy’s Take:

Back in 2021, I had a residential project in Ontario stalled for three months. The panels were sitting in a container at a port in Vancouver, waiting for a truck that didn’t exist. My client was furious. I didn’t blame them—I was frustrated too. Having factories in Indiana or Kentucky means we are dealing with a standard trucking route to the border. It removes the uncertainty of ocean shipping and port congestion.

North American-made modules and batteries will likely see shorter lead times for delivery into Canada. This supports better planning for installers and developers working on tight schedules.

Exploring the Real Price of Canadian Solar’s New Tech

Moving manufacturing to the U.S. changes the cost structure. Labour and material standards in North America are higher than in Asia. Consequently, the production cost of U.S.-made solar panels is higher.

Current market data highlights this difference:

Manufacturing Cost Comparison (Estimated)

| Product Source | Est. Manufacturing Cost (USD/Watt) | Selling Price (Approx.) | Primary Cost Driver |

|---|---|---|---|

| U.S. Made (TOPCon) | $0.33 – $0.41 | $0.25 – $0.30 | Higher labor & material standards |

| Chinese Import | $0.09 – $0.11 | Varies by tariff | Mature supply chain & scale |

Federal incentives help offset the high manufacturing costs, allowing U.S. manufacturers to sell panels below their production cost (around that $0.25-$0.30 range) and still make a profit once the tax credits kick in.

Ignore the daily price fluctuations. Focus on availability. A slightly cheaper battery that sits on a boat for three months costs you more in lost generation than a U.S.-made unit you can install next week. Weigh the total system price against the lifetime value.

Is U.S.-Made Tech Actually a Better Deal?

Shifting to U.S.-based production affects both price and quality considerations for Canadians. You need to check if the new products made in Indiana or Kentucky cost less than previous imports once you factor in shipping and avoided duties.

Compare every quote based on total installed cost, not just the sticker price of the panel. You might pay a premium for the hardware, but you save on risk and potential tariff-related delays.

What to Look For in Specs

If you are evaluating a quote today, ignore the marketing fluff and look at the datasheet.

- Warranty: Look for battery or solar module coverage that lasts 10 years or longer. This is the standard North American benchmark.

- Cycle Life: For batteries, inspect datasheets for cycle life counts above 6,000 cycles. This is standard for Lithium Iron Phosphate (LFP) batteries like the EP Cube.

- Efficiency: Look for roundtrip efficiency rates of at least 90 percent. You do not want to lose power just by charging and discharging the unit.

- Safety: Ensure safety ratings meet CSA Group standards.

Tip for Homeowners: Prioritize brands that have actual service support within Canada. If your inverter fails in February, you do not want to wait for a replacement part to ship from Shenzhen.

Will the New U.S. Facility Lower Battery Prices?

The Shelbyville, Kentucky facility will focus on utility-scale batteries. While this might not drop the price of a residential battery immediately, it stabilizes the market.

Building this facility costs money—about US$712 million for the Kentucky plant alone. Savings from efficient mass production will take time to materialize. However, the IRA subsidies (that $45/kWh combined credit) are massive.

As manufacturing scales up, we might see cost reductions in installed prices for Battery Energy Storage Systems (BESS), especially for large projects. Stronger competition from subsidized U.S.-made batteries will influence pricing in Canada by offering a stable alternative to fluctuating Asian import prices. Additionally, the growing demand for energy resilience is likely to drive interest in home battery upgrade programs in BC, further enhancing the market for BESS. These programs may encourage homeowners to invest in sustainable energy solutions, thereby increasing the overall adoption of battery systems in residential settings. As awareness of the benefits of energy storage solutions expands, we can anticipate a more significant shift toward integrating these technologies into everyday life.

Why Build U.S. Facilities?

Initial investments are high. Canadian Solar is pouring hundreds of millions into these plants. Without subsidies, U.S.-made panels would cost nearly three times as much to make as Chinese alternatives.

The Inflation Reduction Act bridges this gap. Since these subsidies became available, dozens of new solar and storage factories have been announced in the U.S.

These incentives lower operating costs. They help make homegrown renewable energy products price-competitive over time. This drives industry growth and supply chain resilience.

How Does This Benefit Canadians?

Canadian Solar’s move is primarily about capturing U.S. incentives. The IRA subsidies target products sold and used within the United States. Don’t expect an immediate price drop on Canadian quotes. The U.S. gets the cash; we get the product.

However, Canadians benefit from spillover effects.

- Supply Stability: We get access to a supply chain that is not subject to trans-Pacific shipping delays.

- Trade Protection: We are less exposed to trade wars between the U.S. and China.

- Availability: As output grows in Kentucky and Indiana, more product becomes available for the North American market as a whole.

For now, this positions Canadian Solar as a strong player. We get the reliability of a neighbour’s production, even if we don’t get their tax credits.

Future Expansion and Grid Stability

Rising demand for solar power and energy storage in Canada encourages companies to keep investing. Canadian Solar’s e-STORAGE unit reports a huge global development pipeline.

If Canadian provinces offer more aggressive incentives in 2025, we might see manufacturing expand here. For now, the U.S. facilities will help meet our rising needs.

The Role of BESS

Battery Energy Storage Systems (BESS) are essential. They store excess electricity during low use and release it when demand rises.

- Peak Shaving: Reduces demand charges.

- Load Shifting: Moves usage to cheaper times.

- Backup Power: Keeps the lights on during outages.

Most current units deliver two to four hours of power. There is rising interest in six- to ten-hour capacity for better reliability.

Solar Power Incentives and Strategy

Canadian Solar is playing the cards they were dealt. They formed CS PowerTech to tap into U.S. tax credits while meeting trade guidelines.

For Canadian buyers, this reinforces the need to use our own available incentives.

Tip for Financing:

Canada’s Greener Homes Loan has offered interest-free financing up to $40,000 for eligible retrofits, including solar and storage. However, the application portal closed to new applicants in October 2025. If you applied before then, check your status. For new projects, ask your installer about current provincial alternatives or bridge financing, as funding windows open and close quickly.

Conclusion

Canadian Solar’s shift to build batteries and modules in the U.S. is a strategic play for stability. It reduces supply chain risks, cuts tariff exposure, and leverages the Inflation Reduction Act.

For us in Canada, it means better access to stock and shorter wait times. Prices won’t plummet immediately. You are paying for reliability, not just a product. If you are in the market, check the specs, look for the 10-year warranty, and ask your installer where the hardware is coming from.

FAQs

1. Is the Kentucky factory making batteries for my house? Not exactly. The Shelbyville, Kentucky facility is focused on utility-scale storage systems (like the SolBank). For home backup, you should look at residential units like the EP Cube. Ask your installer where their residential stock is assembled.

2. Will this new U.S. manufacturing plant lower battery prices for consumers? It will not happen overnight. However, local production cuts expensive shipping fees and tariff costs. This helps stabilize pricing and prevents sudden cost spikes for Canadian buyers.

3. How could this change affect the availability of batteries in Canada? Shifting production to Kentucky and Indiana means critical components are now a day’s drive from Ontario. This dramatically reduces lead times compared to waiting for shipments from China.

4. What should I ask my installer to get the best deal? Ask specifically about the Total Installed Cost and the Warranty Terms. Ensure the battery uses LFP chemistry for safety and longevity (6,000+ cycles). Also, ask if the equipment qualifies for any remaining provincial rebates or financing programs now that the federal loan portal has closed.

References

- Canadian Solar Announces US Module Manufacturing Facility

- e-STORAGE Opens Manufacturing Facility in Shelbyville, Kentucky

- Reuters: Canadian Solar to Invest $800 mln in Cell Plant

- Grant Thornton: Section 45X Tax Credit Explanation

- PV Magazine: US Solar Module Manufacturing Costs

- Canada Greener Homes Loan

- Navius Research: Energy Storage Market in Canada